Managing healthcare costs can feel like deciphering a complex code. Three acronyms frequently pop up: HSAs, HRAs, and FSAs. But what exactly do they mean, and which one is right for you? Let’s break down these accounts and explore how they can help you save on qualified medical expenses.

Managing healthcare costs can feel like deciphering a complex code. Three acronyms frequently pop up: HSAs, HRAs, and FSAs. But what exactly do they mean, and which one is right for you? Let’s break down these accounts and explore how they can help you save on qualified medical expenses.

Understanding the Accounts:

Health Savings Accounts (HSAs): You contribute pre-tax dollars to your HSA, which acts like a savings account dedicated to qualified medical expenses, including most over-the-counter (OTC) medications. However, to be eligible for an HSA, you must be enrolled in an High Deductible Health Plan (HDHP), which has a higher deductible than traditional health insurance plans. This means you’ll pay more out-of-pocket before your insurance kicks in. HSAs essentially act as a safety net to offset these higher deductible costs.

Flexible Spending Accounts (FSAs): These accounts allow you to set aside pre-tax salary contributions to cover qualified medical and dependent care expenses throughout the year. Think of it like a prepaid debit card for approved healthcare costs. Most OTC medications are eligible for reimbursement through an FSA debit card or claim submission process. Unlike HSAs, FSAs are not tied to a specific health insurance plan type, so you might have the option to contribute to an FSA even with a traditional plan (though some employers may have restrictions based on your plan selection). o FSAs have a “use it or lose it” provision: Generally, you must use the money in a FSA within the plan year (but occasionally your employer can offer a grace period of a few months).

Health Reimbursement Arrangements (HRAs): These employer-sponsored accounts let companies contribute funds to cover qualified employee medical expenses. The specific eligible expenses, including OTC items, vary depending on the HRA plan design set by your employer. Unlike HSAs and FSAs, you don’t directly contribute to an HRA. Instead, your employer contributes on your behalf, or in some cases, a combination of employer and employee contributions may be allowed.

Who Can Use Them?

HSAs: Eligibility hinges on having an HDHP.

FSAs: Generally available to most employees, regardless of health plan type (though some employers may restrict enrollment based on plan selection).

HRAs: Offered at the discretion of your employer, who determines eligibility and contribution levels.

Tax Benefits:

All three accounts offer tax advantages:

Contributions: Reduce your taxable income by contributing pre-tax dollars.

Growth: Interest earned on the funds in HSAs and some FSAs (depending on the plan) grows tax-free, allowing your savings to accumulate faster.

Withdrawals: When used for qualified medical expenses, withdrawals are tax-free for all three accounts.

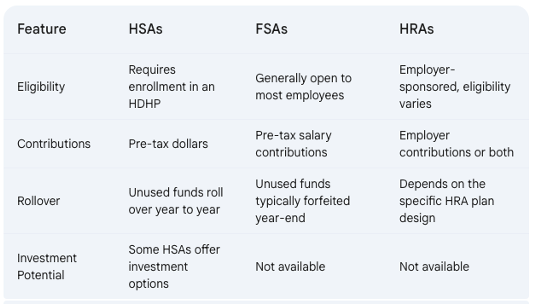

Key Differences:

Choosing the Right Account for You:

The best account for you depends on your individual circumstances. Here are some factors to consider:

- Health Status: If you’re generally healthy and have predictable medical expenses, an FSA might be a good choice, allowing you to use the funds throughout the year.

- Financial Risk Tolerance: HSAs offer long-term savings potential with rollovers and investment options (in some plans). However, they require enrollment in an HDHP, which means you’ll shoulder higher upfront costs before insurance kicks in. Consider your comfort level with potentially higher out-of-pocket expenses.

- Employer Benefits: HRAs depend on your employer’s plan design. If your employer offers a generous HRA with significant contributions, it might be a good option for you.

Additional Considerations:

- Use-It-or-Lose-It vs. Rollover: FSAs typically operate on a “use-it-or-lose-it” basis, so plan your contributions carefully to avoid losing funds.

Making an Informed Decision:

By thoroughly understanding HSAs, FSAs, and HRAs, you can choose the account that best aligns with your health needs, financial goals, and employer benefits, ultimately saving you money on healthcare expenses.